How to Get a Free Property Valuation Online in Minutes (UK Guide)

Knowing your property’s market value is one of the most critical steps in the home-selling process. Whether you’re preparing to move, considering equity release, or simply monitoring your investment, a valuation provides vital insight.

In today’s digital age, it’s possible to get a free property valuation online in just minutes without any pressure or obligation.

This guide will walk you through everything you need to know about how to get a free property valuation online, what to expect, which data influences value, and how to act on it, especially if you’re aiming to sell quickly for cash.

Why Online Property Valuations Matter

Understanding your property’s market value is essential for:

- Selling your home

- Re-mortgaging or equity release

- Insurance purposes

- Dispute resolution (e.g. divorce or inheritance)

- Financial planning

The UK property market is dynamic, shaped by regional demand, economic shifts, and evolving buyer priorities. Online property valuation tools leverage algorithms, historical sales data, and location-based comparisons to deliver near-instant estimates. While they’re not a substitute for a formal RICS survey, they’re ideal for initial decision-making, especially when time or cost is a concern.

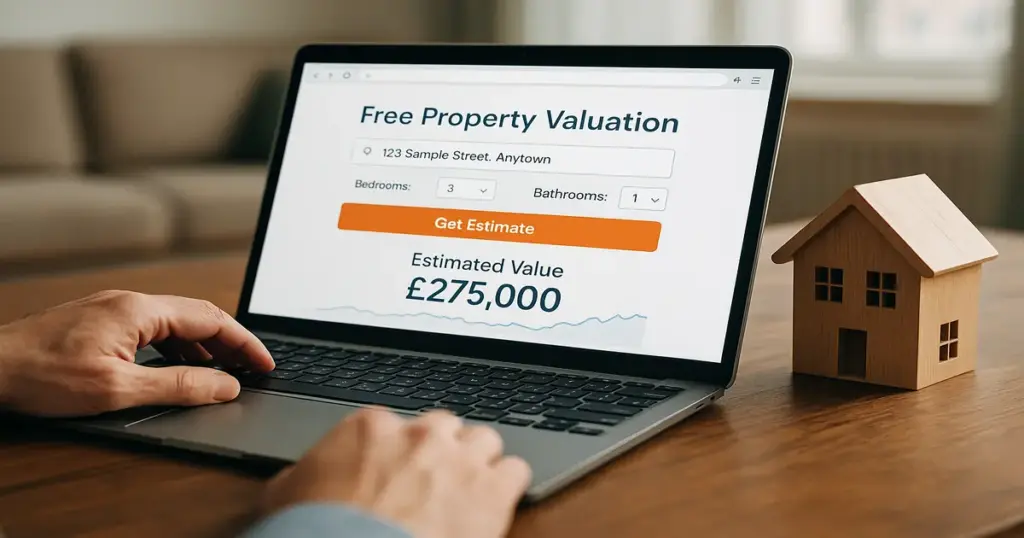

How to Get a Free Property Valuation Online

Step 1: Locate a Reliable Valuation Platform

Several reputable platforms offer instant, no-obligation valuations. These tools typically request the property’s address and ask a few follow-up questions about its size, condition, and any recent renovations. The process is anonymous, free, and fast.

Step 2: Input Key Details

You’ll be asked to confirm the number of bedrooms and bathrooms, whether the property is detached, semi-detached, or flat, and its overall condition. More detailed responses typically yield more accurate results.

Step 3: Receive Your Estimate

Most tools deliver an estimate within seconds. Some may show a value range based on local sales data. These are algorithm-driven outputs calculated using Land Registry records, comparable sales, and current market trends.

Step 4: Compare Multiple Valuations

For a clearer picture, use more than one service. Differences between platforms can highlight data inconsistencies or indicate volatility in your local market.

Step 5: Speak to a Professional (Optional)

Many platforms offer the option to arrange a follow-up with a local agent or valuation expert for a more tailored assessment. You’re under no obligation to proceed with them.

What Influences an Online Property Valuation?

Online valuations in the UK depend on various data points:

- Location and postcode desirability

- Type of property (flat, terraced, semi, detached)

- Size and number of bedrooms/bathrooms

- Proximity to transport links, schools, and amenities

- Property condition and age

- Historic sale prices

- Recent comparable sales (last 6–12 months)

These factors combine to provide a ballpark figure. However, automated tools can’t account for interior design, structural issues, or unregistered improvements, such as extensions, unless they are manually added.

Advantages of Free Online Valuations

- Instant results

- No cost or commitment

- Private and hassle-free

- Ideal for quick planning

- Accessible 24/7

They’re perfect for gauging your home’s value before taking the following steps—whether you’re testing the market, refinancing, or planning a quick sale.

Limitations of Online Valuation Tools

Despite their convenience, online valuations come with caveats:

- Data Lag: Tools may use outdated sales data that doesn’t reflect current conditions.

- Lack of Nuance: They don’t consider property interiors, extensions, or recent refurbishments.

- Market Sensitivity: They can’t detect shifts in buyer sentiment or seasonal demand.

- Broad Ranges: Some estimates may vary by tens of thousands of pounds.

That said, they’re still the quickest and most accessible way to get a general idea of value.

Sell House Fast for Cash: Why It Matters

For homeowners who receive an online valuation and decide to sell quickly—perhaps due to debt, divorce, inheritance, or relocation—working with a cash property buyer is often the fastest, most straightforward route.

Sell your House fast for cash offers:

- Quick sales in as little as 7 days

- No need for repairs, listings, or agent fees

- No chain – removing delays and uncertainty

- Cash offers based on current condition

- Discreet and flexible service

Once you’ve completed your online valuation, you can use that as a benchmark to assess offers from cash buyers. While a cash offer may be below the full market value, it eliminates the need for months of waiting, reduces legal hassle, and provides certainty, especially in urgent scenarios.

Statistics on UK Property Valuations and Market Conditions

- Over 78% of UK homeowners now start their selling journey with an online valuation tool.

- The average UK house price was £282,776 as of early 2025, according to the latest ONS data.

- Homes that are realistically priced based on online valuation data sell 40% faster than those overvalued.

- Nearly 1 in 5 property sales in the UK now involve a cash buyer, up from 1 in 10 a decade ago.

- London, Manchester, Bristol, and Leeds experience the highest volume of instant online valuations each month.

These figures reinforce the increasing reliance on digital tools for property decision-making and highlight the growing appetite for cash sale options.

When Should You Use a Free Online Property Valuation?

- Before listing your home

- To estimate equity for refinancing

- During separation or divorce

- For probate or inheritance planning

- Before approaching a cash buyer

- To track property value growth over time

It’s a low-risk, high-value step that fits neatly into any selling, planning, or investing strategy.

Sell House Fast for Cash: How We Help

If your free property valuation shows a figure that motivates you to sell—and time is of the essence—Sell House Fast for Cash is here to assist.

We offer:

- Free no-obligation cash offers based on your valuation

- Flexible completion dates to suit your needs

- Assistance with legal paperwork

- A team experienced in distressed and urgent sales

- Discreet, professional service with no hidden fees

Your online estimate serves as our starting point; we then conduct a simple assessment and provide a cash offer within 24 hours.

FAQs: How to Get a Free Property Valuation Online

Q1: Is an online property valuation free?

Yes. Reputable UK platforms offer completely free valuation tools without obligation or charges. Some may follow up with agent offers, but there’s no commitment.

Q2: How accurate are online valuations?

They’re based on data and provide a broad estimate. For a precise value, especially if you’re selling, follow up with a cash buyer or a real estate agent.

Q3: Can I use the valuation to set a selling price?

It’s a good idea, but not a final figure. Always factor in demand, local conditions, and recent sales.

Q4: Will using more than one tool give better results?

Yes. Comparing 2–3 platforms helps balance any inaccuracies and reveals a more accurate price range.

Q5: Can I still sell my House if it’s in poor condition?

Absolutely. Many sellers use valuation tools before contacting a company like Sell House Fast for Cash, which buys homes in any condition, quickly and without hassle.

Q6: How long does an online valuation take?

Typically under 2 minutes. Input your address, answer a few questions, and receive your estimate instantly.

Q7: What’s the best way to get a fast cash sale after valuation?

Once you know your property’s value, contact Sell House Fast for Cash to get a direct offer. We’ll handle everything from paperwork to transfer, typically within a few days.

Final Thoughts

Getting a property valuation online is no longer reserved for the tech-savvy—it’s a mainstream first step for UK homeowners and landlords.

Whether you’re weighing up selling options, planning to release funds, or dealing with a time-sensitive situation like repossession or probate, a free online valuation offers clarity and confidence.

The real value comes not just from the figure but from what you do next.

If you’re seeking certainty, speed, and simplicity—Selling House fast for cash is the trusted route thousands of UK sellers are turning to. Start with a valuation, and let us help you turn that number into a smooth and profitable transition.

Property Valuation Tools

Zoopla – Free Instant Property Valuation

https://www.zoopla.co.uk/house-prices/Yopa – Online Valuation Tool

https://www.yopa.co.uk/property-valuationRightmove – Price Comparison Report

https://www.rightmove.co.uk/house-prices.htmlMouseprice – Get an Instant Valuation

https://www.mouseprice.com/Read our top Blogs:

Sell My Property Fast For Cash In Wandsworth

What to Do If Your House Won’t Sell: Fast Solutions That Work

How to Sell House Fast: Proven Tips to Get a Quick Sale Without Estate Agents

📞 Call +447702210159 our friendly team for a same-day offer