How to Spot a Legitimate Cash House Buyer – Avoiding Scams in the UK

Trusted Tips to Help You Sell Safely and Confidently

Selling your house to a cash buyer in the UK can be an efficient and stress-free route, especially if you need a quick sale.

However, the growing popularity of this market has attracted unscrupulous operators. Fake companies, fraudulent “buyers,” and misleading offers can put your property, finances, and peace of mind at risk.

In this guide, we explore how to distinguish legit cash house buyers in the UK from potential scams.

We explain the red flags to avoid, share practical due diligence tips, and help you identify trusted property buyers who will offer fair deals with complete transparency.

Why Use a Cash House Buyer?

Before diving into spotting scams, it’s helpful to understand why so many sellers choose cash buyers in the first place:

- Speed: Cash buyers can complete purchases in as little as 7 days.

- No chain: There’s no onward purchase to delay the process.

- No fees: Most cash-buying firms cover legal and estate agency costs.

- No repairs needed: You can sell your home as-is, regardless of condition.

- Certainty: Sales are not dependent on mortgage approvals or third-party financing.

However, these benefits only apply when you work with genuine, trustworthy buyers, not opportunists trying to exploit vulnerable sellers.

What Is a Cash Buyer Scam?

A cash buyer scam involves deceptive individuals or companies posing as legitimate buyers. Their goal is usually to trick sellers into:

- Signing undervalued contracts

- Paying unnecessary upfront fees

- Agreeing to hidden clauses that allow price drops at the last minute

- Losing control over the sales process

Scammers may present themselves as professional and even operate slick-looking websites, but their intentions are far from honest.

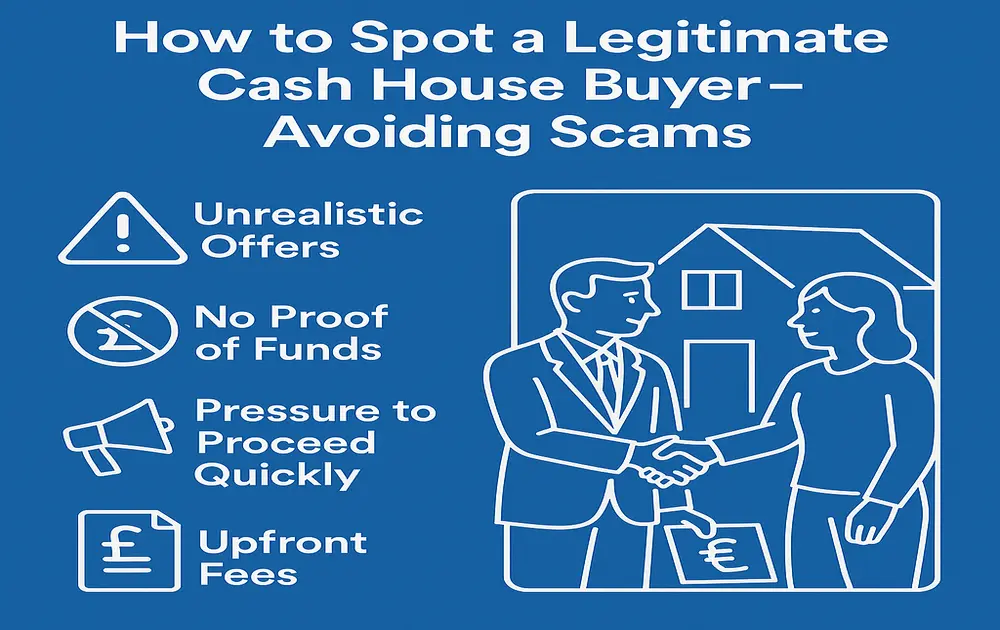

Red Flags: Signs You’re Dealing With a Cash Buyer Scam

Here are the most common warning signs to watch out for:

Unrealistic Offers That Sound Too Good to Be True

Genuine cash house buyers offer fair market value—typically between 75% and 90% of the property’s market value, depending on condition and location.

Be cautious if a buyer promises close to full market value with a fast completion. Scammers often use inflated offers to get your attention, only to drop the price just before the exchange.

Lack of Company Registration or Physical Address

Every legitimate property-buying company in the UK should be registered with Companies House and have a verifiable trading address. If the business is unregistered, or the address appears to be a mailbox or residential home with no staff, that’s a red flag.

No Proof of Funds

A genuine cash buyer should be able to show evidence of liquid funds, such as bank statements or solicitor confirmation. Scammers avoid this or make excuses, like “funds are tied up in another deal.”

Pushy Tactics and Time Pressure

While speed benefits cash sales, no legitimate buyer should pressure you to sign contracts immediately or discourage you from seeking independent legal advice. High-pressure tactics are often used to bypass scrutiny.

Request for Upfront Fees

This is a major red flag. Trusted property buyers never ask sellers to pay valuation fees, legal costs, or admin charges in advance. Any buyer demanding payment before completion is likely running a scam.

Lack of Regulatory Membership

Legitimate cash buyers are usually members of The Property Ombudsman (TPO) or the National Association of Property Buyers (NAPB). These organisations enforce codes of conduct and offer dispute resolution. Scammers often have no affiliations or display fake logos.

Sudden Price Drops Before Exchange

This trick—”gazundering“—involves drastically reducing the offer at the last moment, when the seller feels committed. While some buyers may adjust prices after surveys, sudden, unjustified drops are a serious red flag.

How to Identify Legit Cash House Buyers in the UK

Check Company Credentials

- Companies House: Find the business name to verify registration status, incorporation date, and directorships.

- Trading Address: Google the address. Avoid companies that hide their location or list virtual offices.

- Professional Email & Phone: Reputable buyers use company email domains (e.g., [email protected]), not free services like Gmail or Yahoo.

Ask for Proof of Funds

Ask the buyer to provide:

- A letter from their solicitor confirming they hold sufficient funds

- Bank statements showing liquidity

- Details of previous completed purchases

A trustworthy company won’t hesitate to share this information confidentially.

Read Reviews and Case Studies

Search for Google reviews, Trustpilot ratings, or even Facebook feedback. Be wary of firms with zero reviews or only generic five-star ratings. Reputable buyers often provide detailed case studies with timelines and testimonials from past clients.

Ensure Membership of Industry Bodies

- The Property Ombudsman (TPO): Mandatory redress scheme for property buying companies

- National Association of Property Buyers (NAPB): Members must follow a strict code of practice and also be TPO members

You can verify membership directly on these organisations’ websites.

Use a Solicitor You Choose

Never agree to use the buyer’s solicitor unless you trust the arrangement. Always appoint your independent conveyancer to protect your interests. This ensures you’re fully informed before signing anything.

Request a Written Offer with No Hidden Clauses

Ask the buyer to provide a formal offer letter stating:

- Offer amount

- Timeframe for exchange and completion

- Any conditions (e.g., survey required)

- Whether the offer is subject to renegotiation

Avoid offers with vague terms or complex conditions.

Questions to Ask a Cash Buyer

Before committing, ask the following:

- Are you buying with your cash or relying on investor funds?

- Can you show proof of available funds?

- Do you charge any fees to sellers?

- Are you registered with The Property Ombudsman?

- Do you offer a guaranteed completion date?

- Can I speak to previous sellers you’ve worked with?

A legit buyer will answer all questions confidently and transparently.

What to Do If You Suspect a Scam

If you feel something is off, trust your instincts and:

- Stop communication immediately.

- Report the scam to Action Fraud via their website or 0300 123 2040.

- Consult a solicitor before signing anything.

- Alert others by leaving a review or sharing on property forums and social media.

Your action could prevent others from falling victim.

Why Use a Trusted Property Buyer?

A trusted property buyer delivers a service based on transparency, speed, and professionalism. Here’s what you can expect:

- A fair offer with no hidden charges

- A legally binding offer that won’t change

- A fixed completion date that suits your schedule

- Coverage of legal fees and survey costs

- A smooth process with constant communication

Unlike estate agents, trusted cash buyers won’t delay or pull out due to market shifts or mortgage issues. If speed, certainty, and simplicity matter to you, the right buyer can be a valuable solution.

Final Thoughts: Don’t Settle for Less Than a Legitimate Cash Buyer

Selling a property is a significant financial transaction. While cash sales offer speed and simplicity, it is crucial to avoid the growing number of scams in this sector.

Take your time, research, and don’t be afraid to ask tough questions. A legit cash house buyer in the UK will welcome scrutiny and operate with complete transparency from day one.

If a deal feels too good to be true—or you’re being rushed, misled, or asked for upfront money—walk away. Trustworthy companies will give you the space and security you need to make the right choice.

Frequently Asked Questions (FAQS)

Q1: How much do legitimate cash buyers usually offer?

Legitimate buyers typically offer 75%–90% of the market value, depending on the condition of the home, its location, and the urgency of the sale.

Q2: How do I verify if a buyer is real?

Check Companies House registration, look for TPO/NAPB membership, and request proof of funds and written offers. Use your solicitor.

Q3: Should I ever pay upfront fees?

No. Legitimate buyers cover costs like valuations and legal fees. Any demand for upfront payments is a red flag.

Q4: Can cash buyers change their offer at the last minute?

They shouldn’t. A trustworthy buyer provides a binding offer and only adjusts it if new information (like structural damage) arises. Scammers often drop offers just before the exchange.

Q5: Are all property buying companies the same?

Not at all. Some are ethical, professional, and regulated—others are not. Do your homework and choose companies with a long track record, verified reviews, and professional affiliations.

Official Resources to Verify Cash Buyers

Official Resources to Verify Cash Buyers

Companies House – Check if a buyer is a registered UK company:

https://www.gov.uk/get-information-about-a-companyThe Property Ombudsman (TPO) – Confirm if a buyer is a member and understand your rights:

https://www.tpos.co.uk/National Association of Property Buyers (NAPB) – List of vetted cash buyers in the UK:

https://www.napb.co.uk/member-directory/Action Fraud UK – Report a scam or suspicious property buyer activity:

https://www.actionfraud.police.uk/

Review Platforms to Assess Buyer Credibility

Review Platforms to Assess Buyer Credibility

Trustpilot – Property Buying Company Reviews

https://www.trustpilot.com/Google Reviews – Search by Company Name

https://www.google.com/maps

Speak to a Trusted Buyer You Can Rely On

If you want to sell your house quickly and safely for cash, always deal with a reputable UK-based buyer with verifiable credentials and glowing customer feedback. Our company provides honest offers, no fees, and a stress-free sale, backed by regulatory membership and 5-star reviews.

Contact our team today for a free, no-obligation valuation from one of the most trusted property buyers in the UK. Sell smart, sell safe, sell with confidence.

📞 Call +447702210159 our friendly team for a same-day offer

Read our top Blogs:

Sell My Property Fast For Cash In Wandsworth

What to Do If Your House Won’t Sell: Fast Solutions That Work

How to Sell House Fast: Proven Tips to Get a Quick Sale Without Estate Agents