The Property Buying Pocess Guide

This comprehensive guide provides a detailed money timeline for buying a property in England, Wales, and Northern Ireland.

We understand the complexities of purchasing a home and aim to equip you with the necessary knowledge to navigate the process smoothly. From saving for a deposit to finalizing the legal aspects, we cover each step in detail to ensure you understand the financial aspects. Let’s dive in!

Saving for a Deposit

It’s crucial to save for a deposit. A larger deposit improves your chances of securing a mortgage and helps you access better interest rates. We recommend following these steps:

- Determine your target deposit amount based on the property’s value and mortgage requirements.

- Create a budget to identify areas where you can save money. Cut unnecessary expenses and consider additional income streams.

- Open a dedicated savings account and automate regular contributions.

- Explore government schemes such as Help to Buy ISAs or Lifetime ISAs that offer bonuses on your savings.

- Getting a Mortgage Agreement in Principle

Before actively searching for a property, obtaining a Mortgage Agreement in Principle (AIP) is beneficial. Here’s how to proceed:

- Research various mortgage lenders and compare their offerings, interest rates, and terms.

- Gather necessary documentation, including proof of income, bank statements, and identification.

- Apply for an AIP online or through a mortgage broker. Provide accurate information to ensure a reliable estimate of your borrowing capacity.

- Once approved, you’ll receive an AIP certificate demonstrating your financial credibility to potential sellers.

- Finding Your Ideal Property

Now that your finances are in order, it’s time to find your dream home. Consider the following steps:

- Determine your requirements, such as location, property type, size, and amenities.

- Utilize online property portals, local estate agents, and social media groups to search for suitable properties.

- Attend viewings and take thorough notes. Evaluate each property based on your predetermined criteria.

- If you find a property you love, consider making an offer, considering the current market conditions and property valuation.

- Conveyancing and Surveying

Conveyancing and surveying are essential aspects of the home-buying process. Here’s what you need to know:

- Instruct a solicitor or licensed conveyancer to handle the legal aspects of the purchase.

- They will conduct necessary searches, review contracts, and communicate with the seller’s solicitor to ensure a smooth transaction.

- Arrange a property survey to identify any potential issues or structural concerns. This will help you make an informed decision before proceeding further.

- Applying for a Mortgage

Once you’ve found your ideal property and completed the legal groundwork, it’s time to secure your mortgage:

- Contact your chosen mortgage lender and initiate the application process.

- Provide all requested documents promptly, including proof of income, identification, and property details.

- The lender will thoroughly assess your application, including a credit check and property valuation.

- You will receive a formal mortgage offer detailing the terms, conditions, and interest rates if approved.

- Exchanging Contracts and Completing the Purchase

The final stages of buying a property involve exchanging contracts and completing the purchase. Here’s what to expect:

Your solicitor or conveyancer will review the contract, ensuring all legal obligations are.

They are fulfilled and negotiated any necessary amendments with the seller’s solicitor. Once both parties are satisfied, you and the seller will sign the contract, and a deposit (usually 5-10% of the property’s value) will be paid.

- The completion date will be agreed upon, typically a few weeks after the exchange of contracts, allowing time for final preparations.

- On the completion day, the remaining balance will be transferred to the seller’s solicitor, and you will receive the keys to your new property.

- Additional Costs and Considerations

While the main financial aspects have been covered, it’s essential to be aware of additional costs and considerations:

- Stamp Duty Land Tax (SDLT): Depending on the property’s value, you may be required to pay SDLT. Research the current thresholds and rates to estimate this expense accurately.

- Removal Costs: Factor in hiring a removal company or arranging transportation for your belongings.

- Home Insurance: Obtain adequate home insurance to protect your investment from unforeseen circumstances.

- Renovations and Furnishing: Allocate a budget for any necessary renovations or property furnishing to your taste.

- Post-Purchase Considerations

Congratulations on your new home! Here are a few post-purchase considerations to keep in mind:

- Notify relevant parties: Inform utility providers, the local council, and any necessary institutions of your address change.

- Set up regular mortgage payments: Ensure you have a reliable payment plan to avoid missed or delayed payments.

- Consider home improvements: Personalize your space and increase its value by undertaking home improvement projects.

- Maintain a contingency fund: Prepare for unexpected repairs or maintenance costs that may arise in the future.

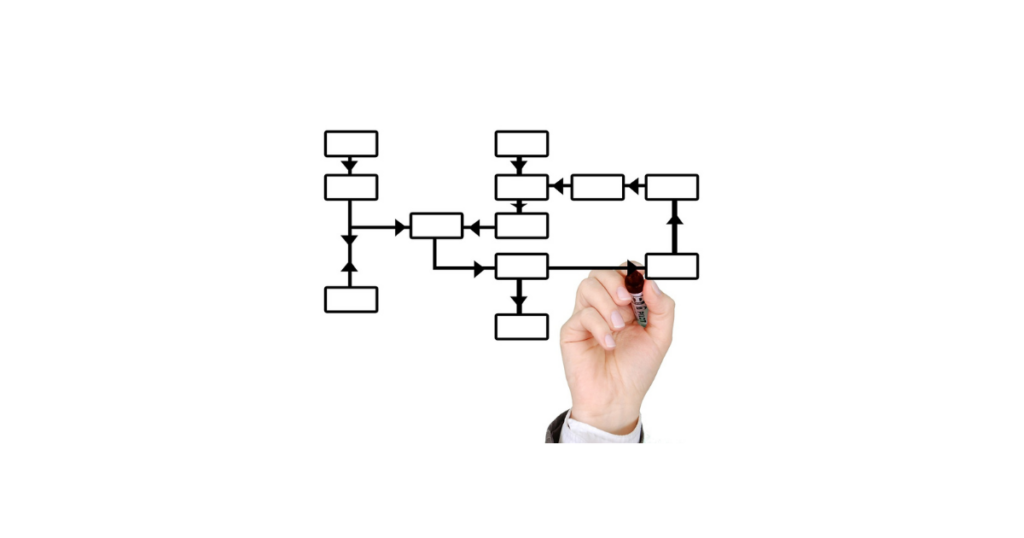

The above diagram illustrates the timeline for buying a property, from saving for a deposit to post-purchase considerations.

Navigating the process of buying a property in England, Wales, or Northern Ireland can be overwhelming, but with the proper knowledge and preparation, it becomes much more manageable.

By following this comprehensive money timeline, you’ll clearly understand the financial aspects involved at each stage. Consult with professionals, such as solicitors and mortgage advisors, to ensure a smooth and successful home-buying journey. Good luck in finding your dream home!

Frequently Asked Questions (FAQ)

Here are some common questions people have when it comes to buying a property in England, Wales, and Northern Ireland:

1. How much deposit do I need to save?

The deposit amount varies depending on the property’s value and mortgage requirements. It’s generally recommended to save at least 5-20% of the property’s value as a deposit. A larger deposit can improve your chances of securing a mortgage with favourable interest rates.

2. What is a Mortgage Agreement in Principle (AIP)?

A Mortgage Agreement in Principle (AIP) is a statement from a mortgage lender that indicates how much they would be willing to lend you based on your financial information. It demonstrates your financial credibility to potential sellers when making an offer on a property.

3. How do I find a suitable property?

To find a suitable property:

- Determine your requirements, such as location, property type, size, and amenities.

- Utilize online property portals, local estate agents, and social media groups to search for available properties.

- Attend viewings and evaluate each property based on your predetermined criteria.

4. What is conveyancing, and why is it important?

Conveyancing is the legal process of transferring property ownership from the seller to the buyer. It involves various searches, contract reviews, and communication between solicitors or conveyancers. Conveyancing is crucial to ensure all legal obligations are met, and the transaction proceeds smoothly.

5. What should I consider when applying for a mortgage?

When applying for a mortgage, consider factors such as interest rates, repayment terms, and the overall affordability of the mortgage. Gather all necessary documents, provide accurate information, and be prepared for a thorough application assessment, including a credit check and property valuation.

6. What additional costs should I be aware of?

In addition to the deposit and mortgage, there are other costs to consider. These include Stamp Duty Land Tax (SDLT) based on the property’s value, removal costs, home insurance, and any renovations or furnishings you may need.

7. What should I do after completing the purchase?

After completing the purchase, notify utility providers and relevant institutions of your address change. Set up regular mortgage payments and consider home improvements if desired. Maintaining a contingency fund for unexpected repairs or maintenance is also wise.

These FAQs cover some key aspects of buying a property in England, Wales, and Northern Ireland. If you have more specific questions or require personalized advice, it’s recommended to consult with professionals such as solicitors, mortgage advisors, or real estate agents.